Electric cars (EVs) are becoming a not unusual sight on roads across the U.S. Many people are choosing EVs to reduce their carbon footprint and keep on gas charges.

But regarding charging, the massive question is: where do you do it? Public charging stations are one choice, but domestic charging is the most handy desire.

And with the federal tax credit score for EV chargers set up, it has never been more affordable to install an EV charger at home. Let’s deLet’s it.

the EV Charger Installation Tax Credit

What is the EV Charger Installation Tax Credit?

The EV charger installation tax credit score is a monetary incentive that allows the price of installing an electric automobile charger at home.

This tax credit is part of the Inflation Reduction Act (IRA),,whichch wilbee surpassed in 2022. The purpose? To make EV possession more extraordinary by decreasing the expenses of at-home charging.

Understanding the Inflation Reduction Act

The IRA is a complete law with many provisions to assist Americans in switching to effortless power. Among those provisions is the tax credit for the setup of an the setup of an EV charger. The tax credit score becomes independent of the credit score to be had for getting an EV,

however,it worked an equal manner. By claiming this credit, you get a discount on the fee of installing an EV charger at your house.

How the EV Charger Install Tax CrHere’sohHere’s

Here’s how the EVhowther install tax credit score works: you may raise the amount of your installation charges covered by the government, with a cap of $1,000.

Under that method, if you spend $3,000 on your chChargernd installation, you can get a $900 $900 rebate.

The concept is to make home charging inexpendon’tsnedondon’don’tupont have to rely onn slow or costly public chargers.

Eligibility for the EV Charger Installation Tax Credit

Now, who can declare this tax credit score? Not every person is eligible. You need to meet parLet’sar necessities. Let’s talk about how Letlookho qualifies for this economic destruction.

Where Can You Claim the Credit?

The credit is available for EV chargeyou’rekpyou’reg tyou’ren home. So, if you’re you’re you’re a charger in may’tterprise or public place; you may clmamaysclay this one.

This benefit is for house owners seeking to set up a handy and cost-effective charging answer.

Low-Income Areas vs. Rural Areas (H4)

The tax credit is geared toward low-profits and rural areas. Why? These places regularly have fewer public charging options, making domestic setsetupe critical..

The IRS has clarified that the credit score applies in most cases in these areas, though new research indicates it covers up to two-thirds of the U.S. Population.

A map supplied by the Energy Department allows you to check whether your place qualifies.

How Much Can You Save with the EV Charger Install Tax Credit?

How much can you get with the EV charger set uLet’sdit? Let’s treat the numbers.

Bre more in-depth making Down the 30% Rebate..

The EV charger installation tax credit score covers 30% of the full price of the installation. For examplehe whole total is $2,5you’dou’d get a score of $750.

This rebate could make a giant distinction in decreasing the cost of putting in place your house charger.

Tax Credit Cap: What Does $1,000 Mean?

The credit is capped at $1,000. Regardless of how much you spend on setsetupou could best declare as much as $1,000.

If your installation fees are more than that, you will not receive a financial credit, but $1,000 remains an extraordinary gain.

Benefits of Installing an EV Charger at Home

Why should you install an EV charger at home in the first place? There are a number of motives that make this a smart decision.

Convenience and Cost Savings

First oit’siconit’sentcontenttidon’tent notrce yourselfblic charging station. You can plug it into your automobile at night, and it will beready to gooorning.

On the pinnacle of that, it’s it’stcheit’srging at home is typically more low-cost than public stations, and with the tax credit score, the fee to put in the chargrill becomes much more manageable.

How to Apply for the EV Charger Install Tax Credit

Applying for the EV charger set-up credit is simple, but you’ll have some syou’llo ensure you get the total advantage.

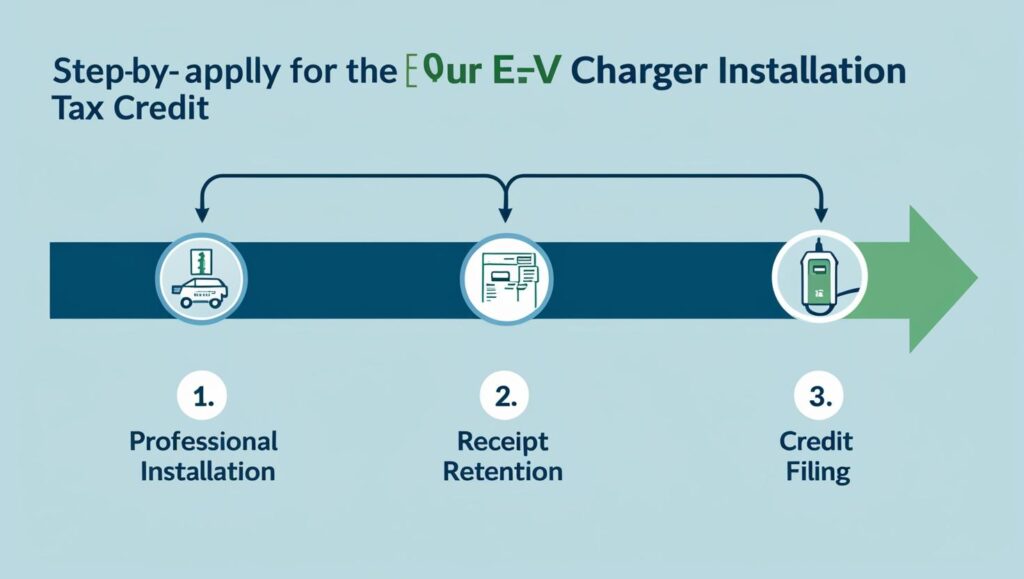

Step-by way of-Step Process

- Get the ChChargernstalled: Have your EV charger installed by a certified professional. Make sure the installation is carried out nicely and correctly.

- Keep the Receipts: Make a poinpoint of keepingeipts for the charger and installation costs. You’ll neneneYou’llse toert your credit.

- File for the Credit: When you record your taxes, you’ll dyou’lyou’llEdyou’ller installation tax credit score. Be sure to include any necessary paperwork and documentation, which may also include proof of setupsetup and the prices concerned.

Gathering the Required Documents

It’s crucial It’srepare alcrucial to prepareance. This includes receipts, includeprices, and any opricesyincludes icessor providprice yourverything ready will make the tax submitting technique much smoother.

Is the EV Charger Installation Tax Credit Available Everywhere?

The tax credit is not to beabe aavailable in your areabefore you get excited, it’s vititvvit’savailable in the future qualifies.

IRS Guidance on Eligiblvital to check

The IRS has set particular hints for where the tax credit score applies. It’s maiIt’It’scmaiIt’fortly for comfort in southern, latestthfor clatest forest applies to two-thirdthe two-thirdsns.

A map from the Energy Department will assiyou cancan help you determiwhetherern eligiblcanan help you determine whether

Energy DeparDepDeparDepartment’s

The Energy Department has created a mapping tool to make it easy for owners. This device lets you test if your area qualifies for the EV chsetupset-up tax credit. If your area qualifies, you may practice for the credit when filing your taxes.

Conclusion: Making the Most of Your EV Charger Installation Tax Credit

The EV charger installation tax credit is a splendid opportunity for homeowners switching to electric cars. Protecting 30% ofsetupset-up prices makes domestic charging more low-cost.

If you qualify primarset-upsed on place, this incentive can signaffordabley reduce the advance price of installation, making it easto enjoy EV ownership’s advantagesship.

1 thought on “Everything You Need to Know About the EV Charger Installation Tax Credit”