If you’ve been considering switching to an electric vehicle (EV), you’ve probably heard about the federal tax credit for electric-powered car chargers.

This credit makes it easier for homeowners to install EV chargers, offering financial assistance for the acquisition and set-up. Let’s test how this credit score works, who qualifies, and how you could observe for it.

Federal Tax Credit for Electric Vehicle Charger

What is the Federal Tax Credit for Electric Vehicle Chargers?

Understanding the Basics of the Tax Credit

The federal tax credit for electric-powered car chargers is a government initiative. It helps cover part of the fee of installing an electric automobile charger at domestic.

This credit applies to Level 2 chargers, which are faster than fundamental Level 1 chargers. You can receive up to 30% again at the installation prices, decreasing the general rate.

Why Should You Take Advantage of the Federal Tax Credit for Electric Car Chargers?

Environmental and Financial Benefits

Switching to an electric-powered vehicle isn’t always exact to your wallet; it’s also accurate for the surroundings. Electric cars produce fewer emissions than traditional fuel-powered cars.

By installing a charger at home, you’re additionally assisting to reduce your carbon footprint. This is a small, however important step in the fight against weather alternates.

On the financial facet, the tax credit makes it more less costly to price your EV at home. With the growing fees of gas, an electric powered automobile can save you money in the long run. This credit score makes it less difficult to set up a dependable charging device at home.

How the Federal Tax Credit Can Lower Your Costs

The credit can cowl 30% of the total price of putting in the charger. If you spend $2,000 on the acquisition and installation, the tax credit may want to decrease your fees by up to $600.

While it would not cover the entire value, it extensively reduces the economic effect. For corporations, the credit score can be as high as $30,000.

This is a notable manner to ease into EV possession without breaking the financial institution. When you issue in the savings on fuel and renovation that come with owning an EV, the tax credit turns into a totally attractive choice.

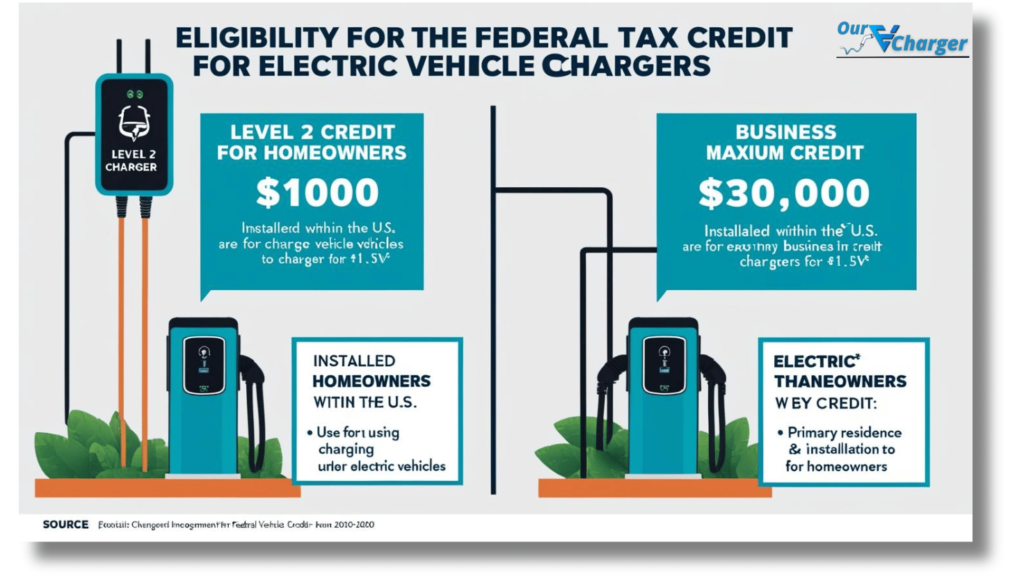

Eligibility for the Federal Tax Credit for Electric Vehicle Charger

Who Qualifies for the Credit?

Not every body qualifies for the federal tax credit for electric powered car chargers. It applies to those who set up a Level 2 charger at their primary house. To qualify, the charger have to be set up inside the U.S., and it must be for charging an electric car.

Businesses can also qualify for the tax credit score in the event that they deploy EV chargers on their premises. The quantity of credit to be had relies upon on the sort of set up—house owners can declare up to $1,000, while companies can receive as much as $30,000.

What Requirements Must You Meet?

There are a few key necessities you need to meet a good way to declare the tax credit score. First, the charger should be hooked up at your number one house or enterprise.

The gadget need to be used totally for electric car charging. The gadget have to also meet sure requirements set by way of the IRS.

Also, the installation have to be achieved through a certified professional, inclusive of an electrician, to ensure the device is installation correctly and successfully. Without meeting those standards, you may not be eligible for the credit.

How to Claim the Federal Tax Credit for Electric Vehicle Charger

Steps to Apply for the Tax Credit

To declare the federal tax credit, you’ll want to take some easy steps. First, make sure you maintain all of your receipts and documentation related to the acquisition and installation of the charger. This may be critical while submitting your taxes.

Next, you’ll need to finish IRS Form 8834. This form is used to say tax credits associated with electric car charging stations. Once finished, publish it together with your tax return. If you’re uncertain about the manner, consulting a tax expert can help ensure everything is filed successfully.

What Documentation Is Needed?

To record for the tax credit score, you’ll want the following:

- Receipts for the charger and installation

- Invoices from the electrician who installed the charger

- Any office work related to the charges worried in putting in place the charger

- Keeping these files organized will make the filing system lots less difficult.

Other Tax Credits and Incentives for Electric Vehicle Owners

State-Specific Tax Credits and Incentives

In addition to the federal tax credit, many states provide their very own incentives for EV proprietors. These can encompass nation tax credit, rebates, or exemptions from positive expenses.

Some states even offer loose charging stations or get entry to to carpool lanes for EV owners. It’s really worth gaining knowledge of the incentives to be had for your country to maximise your savings.

Rebates and Grants for Electric Car Chargers

Many nearby governments and software businesses offer additional rebates and grants to assist cowl the value of putting in EV chargers.

These rebates can frequently be blended with the federal tax credit score, making it even greater low priced to install a charger at domestic.

Check with your software enterprise or neighborhood government to find out approximately any extra incentives available on your vicinity.

Conclusion: Make the Most of the Federal Tax Credit for Electric Vehicle Charger

The federal tax credit score for electric automobile chargers offers a brilliant opportunity to lessen the in advance value of installing a charger at domestic.

With savings of as much as 30% on the whole price, this incentive makes it extra low priced to charge your electric powered car at home.

Combined with kingdom-specific rebates and other incentives, you may significantly lessen the cost of going inexperienced.

If you’re thinking about switching to an electric powered automobile, the federal tax credit for electric powered automobile chargers is a economic gain you shouldn’t forget about.

Make certain to test the eligibility requirements, acquire your documentation, and claim the credit score while submitting your taxes. With those simple steps, you can make owning an electric-powered automobile even more low-cost.

1 thought on “Federal Tax Credit for Electric Vehicle Charger – A Complete Guide”